61 years after, the Nigerian economy is still facing post-Independence struggles.

Inflation, infrastructural shortages, insecurity, low forex revenue; while the price of Oil, the country’s most important commodity passed $80 a barrel for the first time in three years last week.

The idea that the economy improves when Oil prices stay high appears to be more fiction than reality these days.

Oil has averaged $67 this year and as of Independence day, settled above $78 per barrel – yet all does not look well in the country. Could it now be a case of correlation versus causation or apples and oranges when we discuss the economy and oil prices?

Food inflation peaked at 22.95% in March 2021 (a 4-year high) and according to World Bank Data, general inflation pushed 7 million Nigerians below the poverty line in 2020 to cement its position as the poverty capital of the world.

So what does Nigeria need to focus on?

First of all… the obvious

Food and inflation

In 2021, food prices accounted for over 60% of the total increase in inflation. In theory, if Nigeria solves the food problem, the Central Bank’s target for a single-digit inflation rate is feasible.

Here comes the need for federal government policies. What should precede the other – Nigeria achieving self-sufficiency or Nigeria becoming a global net exporter of food? The former has more benefits based on the statistical influence food prices have on inflation.

To bring prices down, there has to be a surplus. If there is surplus, the “middlemen responsible for food shortage” narrative would weaken. Middlemen exploit gaps, surplus covers these gaps.

Each state should focus on growing food. Reliance on food from a particular region is unsustainable. Consumption is national so food production cannot be regional as external factors can affect certain regions.

Investment in people

The mass exodus of Nigerians to developed countries should worry the Giant of Africa.

Although the country can make lemonade from the lemons of migration by profiting from remittances from the diaspora (a big source of FX in the country) – there is still a need to address this “brain drain.”

Nigeria has to turn its demographics to opportunity. The most populated country in Africa is yet to translate this quantity to quality. You would argue it has the largest GDP in Africa but of what use is that indicator when its people are the poorest in the world?

Bill Gates has reiterated over time that Nigeria needs to channel more investments towards health, family planning, and education as a means of human development as this is the only way poverty can be alleviated.

Oil is Nigeria’s greatest export and it’s a God-given natural resource – so what can 150-200 million Nigerians offer to the world? Cue, China’s cheap labour force.

Could it be technology?

In different discussions, Nigeria has been touted as the Silicon Valley of Africa. Andela, a global engineering talent outsourcing company launched in Nigeria in 2014, recently secured a $200 million investment during a Series E funding round led by SoftBank Vision Fund 2, the venture capital arm of Japanese mega-corp SoftBank.

SoftBank, owned by one of the richest men in Japan, had earlier invested $400 million in African-focused fintech, Opay.

In the last five years, Nigeria has played host to Ali Baba’s Jack Ma, Facebook’s Mark Zuckerberg, Twitter’s Jack Dorsey, and Google Chief Executive Sundar Pichai. These visits were not for charity or philanthropy – they all identified Nigeria as a potential market for technology.

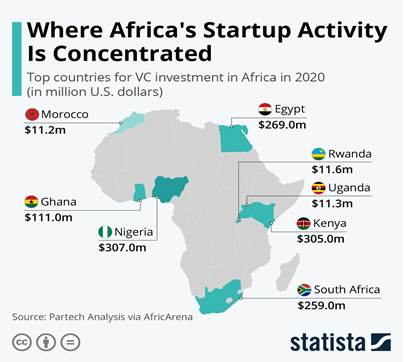

This begs the question – Could Tech be the new Oil? The world’s biggest VCs are now vying for stakes in Nigeria’s tech sector. Nigeria has attracted billions of dollars in funding to the tech ecosystem.

Nigeria enjoys a fertile environment for tech entrepreneurs due to the country’s youthful and growing population, rising internet penetration, and the application of emerging technologies that have the potential to improve access to healthcare, financial services, education, and energy.

This should provide the Nigerian government with an incentive to encourage the space and promote policies so the economy enjoys the ripple effects of their success.

The social media rhetoric of the government being anti-tech does not do the industry any favour – fixing this disconnect should be imperative. Lifting the ban on Twitter would be a rich starting point and passing the beneficial Nigerian startup bill will be an olive branch.

And now…

Industries and services

The dearth of industries and services is a core issue the government should address.

Nigeria is overtly import-dependent and it is evident how importation puts pressure on the exchange rates. There are so many things Nigeria should not be importing given the resources the country has.

The irony of an Oil producing country without a refinery working at optimal capacity is an anomaly. Spending N905 billion in 2021 alone on fuel subsidies should turn heads at Abuja.

Additionally, the government should focus on creating value chains in agriculture. For example, Nigeria can revive the cotton industry so that textile factories can make use of the raw material (cotton) produced in the country rather than importing it. That way the cotton industry can create jobs and preserve the country’s foreign reserves.

Another similar example is inviting international firms to assemble plants in the country. Selling Cocoa to Swiss companies and processing its derivatives in Nigeria will create jobs and circulate the money within the ecosystem.

The nation’s demand for Toyota vehicles should translate to the formation of assembly plants in Nigeria. The Ministry of Agriculture, Ministry of Trade and Investment, and the Central Bank should work on strategies to create these chains.

The mono-economy that is Nigeria should have tourist attractions that can rake in millions of dollars. Zanzibar in Tanzania received 538,264 visitors in 2019 and with data showing that an average guest spends $50 per day – total revenue points at $26,913,200 per day. The ripple effect of tourism will extend to hotels, taxi drivers, museums, supermarkets, and VAT for the government.

Nigeria, just like Korea with its movies and music, can also aim to be a leading exporter of popular culture. It is a way for them to develop their “soft power.” Soft power is a term that refers to the intangible power a country wields through its image.

This image would entice the world to patronize Nigerian products. Nigeria plays host to the biggest artists out of Africa that are dominating global platforms. Sold-out shows and Shazam records abroad attest to that fact. Nigeria needs to leverage the entertainment industry to pull FX into the country.

Insecurity

Insecurity has bedevilled Nigeria in many pathways. Banditry and the herdsmen crisis have affected food distribution and production. Insecurity in the Niger Delta has affected oil infrastructure, oil supply, and investment into the sector.

Insecurity affects Foreign Direct investment. When Nigeria issued Eurobonds, Fitch Ratings affirmed Nigeria’s Long-Term Foreign-Currency Issuer Default Rating (IDR) at ‘B’ with a Stable Outlook but noted that investment inflow continues to be clouded by insecurity and governance challenges.

Since 2000, countries that have improved in security and peace have seen an average 1.4 percentage points higher GDP per capita growth when compared to countries that have become less peaceful as measured by the Global Peace Index (GPI).

Additionally, the average inflation and unemployment rate for the countries with the largest security improvements were substantially lower than those with the largest deterioration.

SMEs and the ease of doing business

The largest employer of labour in any economy is Small and Medium Enterprises. The only business that requires no “connection and little advanced education” is the one that most people in the lower class cannot afford. The Government needs to make the Ease of Doing Business easy.

The one thing…

Infrastructure and judicious use of borrowings

Infrastructure is the engine of any country. Without it, any sort of development would be impeded. Electricity, good roads, social amenities etcetera.

The infrastructure company (InfraCorp) being created by the Central Bank of Nigeria, African Finance Corporation, and the Nigerian Sovereign Investment Authority to raise N15 trillion to solve the country’s infrastructural deficits is a step in the right direction.

The concerns about the country’s debt levels will subside if citizens enjoy the debt benefits through infrastructure.

Conclusion

Nigeria’s problems are harmoniously intertwined such that two or more elements are so interconnected and to fix one problem would require solving another.

If you want the Technology sector to scale, you have to ensure there is an Ease in Doing Business, if you want industries and services to thrive, there has to be infrastructure.

To solve insecurity, you have to invest in people and for people to survive you have to bring down inflation.

Several other combinations can be made around these issues and addressing them would fix other micro-issues – single exchange rate, export substitution, unbridled population growth, subsidy removal, the list goes on.

![[BREAKING] SYLVESTER OROMONI: LAGOS ORDERS INDEFINITE CLOSURE OF DOWEN COLLEGE ~ Fame News](https://www.famenewsonline.com/wp-content/uploads/2021/12/dowen-218x150.jpg)